How UK Mortgage Brokers Are Using WhatsApp to Navigate the £94 Billion Remortgage Wave

How UK Mortgage Brokers Are Using WhatsApp to Navigate the £94 Billion Remortgage Wave

When I talk to mortgage brokers about the next six months, the first reaction is almost always anxiety.

Then comes excitement, once they realise there's actually a solution.

But let's back up for a moment, because the anxiety is completely justified.

The market is genuinely jittery right now. The Guardian recently reported that surveyors are down-valuing properties across the UK, adding pressure to already-stretched buyers in the run-up to the 2025 Autumn Budget. That's creating chaos for new business - buyers suddenly scrambling to find extra deposit, deals falling through, mortgage offers needing to be recalculated.

But that's only half the story.

The Renewal Tsunami

At the same time, there's a tsunami of renewals hitting. UK Finance data shows that 1.6 million fixed-rate mortgages were due to end in 2025, with a similarly high number set to mature in 2026. CACI analysis cited by Barclays indicates that £147 billion worth of mortgages were scheduled for renewal in just a six-month window. And IMLA is forecasting £94 billion in external remortgaging for 2026 alone.

Those aren't abstract market statistics - they're real customers on every broker's books, all approaching their product end dates at roughly the same time.

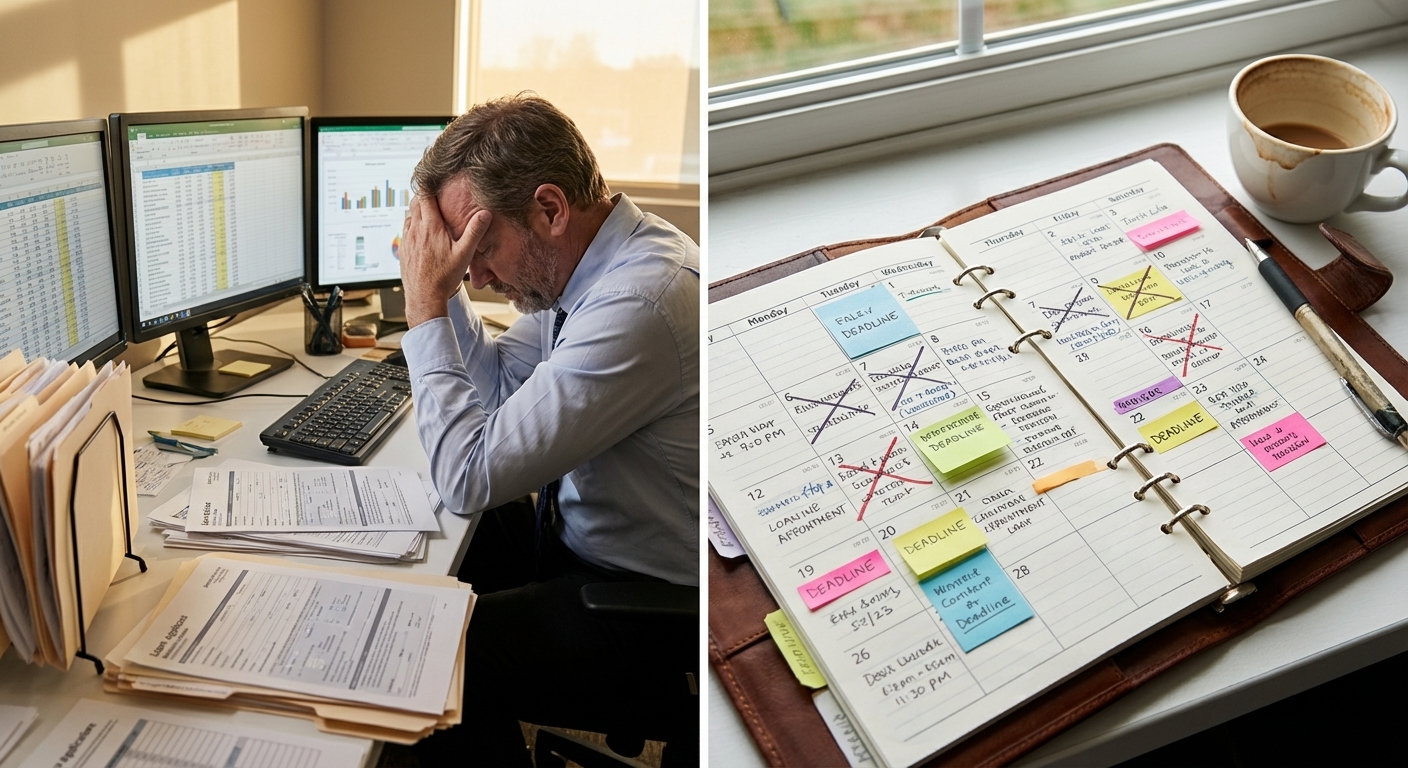

The typical response I hear goes something like this:

"Max, I know these renewals are coming. I can see them in my CRM. But I've got 800 customers hitting their product end dates in the next six months, and I've got three advisers. How am I supposed to proactively contact all of them whilst also handling new business?"

That's the crux of it.

Brokers intellectually understand that this renewal wave is a massive retention and revenue opportunity - quite possibly the biggest they'll see for years.

But operationally, they're terrified because the traditional approach simply doesn't scale.

Not when renewal volumes, new enquiries dealing with down-valuations, and Budget-driven uncertainty are all hitting at once.

The Maths That Doesn't Work

Think about the numbers for a moment.

If you're manually calling each renewal customer, leaving voicemails, sending follow-up emails, chasing them down, that's easily 20 to 30 minutes per customer spread across multiple attempts.

Multiply that by hundreds or thousands of upcoming renewals.

You've basically got a full-time job just doing outreach before you've even given any mortgage advice.

The Hidden Cost of Manual Outreach

I know of one firm that has nine full-time staff doing nothing but this outreach work, all day, every day. That's nine salaries just to chase down renewals and get people to engage.

In smaller brokerages, it often falls to the advisers themselves. Now you've got qualified mortgage advisers spending half their day leaving voicemails instead of actually giving mortgage advice.

Here's where it completely falls apart. If you've got:

500 renewals coming up, and

You're averaging 20 minutes per customer to finally get them engaged

= 167 hours of work

That's four full working weeks for one person doing nothing but chasing renewals.

The Outcome Nobody Wants

The customer ends up reverting to their lender's Standard Variable Rate, paying hundreds of pounds more per month than they need to.

The broker has lost a client, not because they provided poor service, but because they literally couldn't get hold of them in time using traditional methods.

The Collision Nobody Talks About

Let me paint you a picture of what happened to one of our broker clients just last month.

It's 9am Monday morning. The adviser - let's call him James - sits down at his desk with his coffee. He's got three appointments booked today with existing clients whose mortgages are coming up for renewal. Straightforward stuff.

Then at 9:15am, he gets a call from a first-time buyer couple who put an offer in three weeks ago.

They've just had their survey come back. The property they agreed to buy for £285,000 has been down-valued to £265,000. They're absolutely panicking.

Their mortgage offer is based on the higher price, the seller isn't budging on the sale price, and they need to find an extra £20,000 deposit or pull out of the purchase entirely.

This is a crisis that needs immediate attention.

The Domino Effect

James spends the next 90 minutes on the phone with them, running through their options:

Can they get a gifted deposit from family?

Can they switch to a higher LTV mortgage product?

What are the rate implications?

Can they negotiate with the seller?

This is complex problem-solving that requires his full attention and expertise.

By the time he finishes that call, it's nearly 11am. He's now got 30 minutes before his first renewal appointment.

He quickly checks his email and sees that his admin person has forwarded him a list of 15 customers whose product end dates are coming up in the next 60 days and they haven't been able to reach by phone.

"Can you try calling them this week?"

He looks at that list and thinks, "When exactly am I supposed to do that?"

The Day Unravels

His first renewal appointment runs over because the customer is anxious about rates going up and wants to discuss protection insurance as well. That takes him to 12:30pm. He grabs lunch at his desk whilst updating CRM notes from the morning.

At 1pm, another new enquiry comes in through the website. Someone interested in a remortgage but they're self-employed and need specialist lending advice. James makes a quick call to do initial qualification. Twenty minutes.

Then at 1:30pm, his second renewal appointment. Halfway through that call, his mobile rings. It's the first-time buyer couple from this morning. They've spoken to their parents who can gift them £15,000, but they're still £5,000 short. Can they adjust the mortgage application?

James has to ask his renewal client if they can hold for a minute whilst he takes this urgent call.

You see where this is going.

The Inevitable Result

By the end of the day, James has dealt with multiple urgent new business issues that required immediate attention. He's conducted his scheduled renewal appointments. But that list of 15 customers his admin team couldn't reach? He hasn't touched it. Not a single call made.

This isn't a one-off bad day.

This is every day.

The new business enquiries, particularly the ones with complications like down-valuations or affordability issues, are time-sensitive and emotionally charged. They take priority because if you don't handle them immediately, you lose the client to another broker or the deal falls through entirely.

But the renewals? They're not urgent today. The product doesn't end for another two months.

So they keep getting pushed to tomorrow, then next week, then next month. Until suddenly you've got 50 customers whose deals end in three weeks and you're in absolute panic mode trying to contact them all at once.

Why WhatsApp Changes Everything

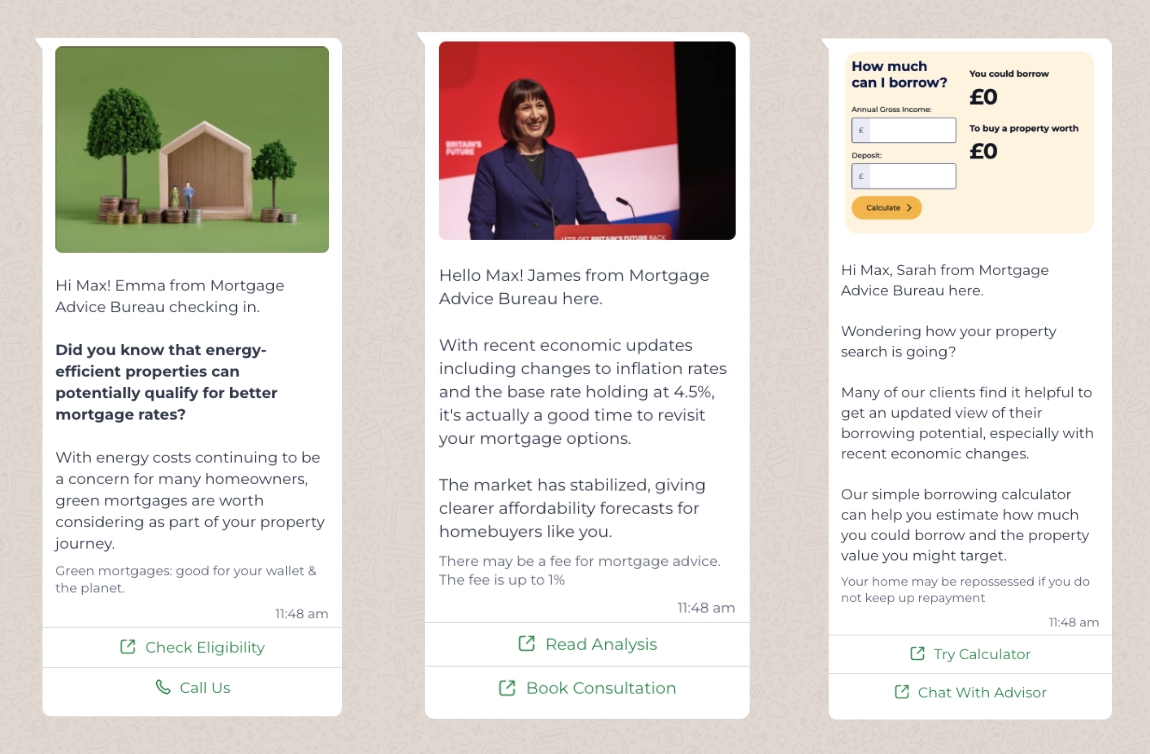

Here's what changes when brokers adopt WhatsApp automation.

We can send personalised renewal reminders to hundreds of customers simultaneously.

"Hi John, your mortgage with Santander ends in three months. Would you like us to help you find a better rate?"

25% or more of those customers will respond and book themselves into the diary.

That's when the penny drops.

Suddenly it's not about how many phone calls you can physically make in a day. It's about proactively engaging your entire book whilst your advisers focus on actually delivering mortgage advice to the people who respond.

The Parallel Processing Advantage

The AI sends those 15 renewal reminders on Monday morning whilst James is dealing with his down-valuation crisis. By Monday afternoon, three of those customers have responded and booked themselves into his calendar for later in the week.

He hasn't made a single call, but he's captured the opportunity.

The renewals don't get deprioritised because they're no longer competing for the same resource: James's time and attention. They're being handled in parallel by automation whilst James focuses his expertise on the complex problems that actually require human judgment and relationship-building skills.

The Dead Leads That Came Back to Life

What's particularly striking is how this applies to leads that firms have essentially given up on.

We worked with Brook Financial Services - part of the Mortgage Advice Bureau network - on a list of lost leads that had been manually called by human beings every week for six months. These were people who just weren't picking up or responding.

The firm was ready to bin the entire list after all that effort had been expended.

We took those same leads and engaged them via WhatsApp with our AI assistant.

We extracted appointments from 11% of them.

That's pure incremental value that would have otherwise been completely written off. Yes, there's a cost to the WhatsApp outreach, but it's completely nominal compared to the salary cost of having staff make hundreds of manual calls.

And crucially, these are existing clients already on the books, so there's no additional acquisition cost involved.

The Day-Two Safety Net

With Fluent Money - the UK’s fastest-growing broker - we're seeing something similar happen much earlier in the funnel.

They've got a phone-based team whose job is to contact new leads within 24 hours. But they're getting such high volumes of inbound leads that even with multiple people making calls all day, they simply cannot make contact with everyone in that first 24-hour window.

Traditionally, those leads that couldn't be reached in the first 24 hours would just die. They'd sit in the CRM with a status of "attempted contact, no response" and eventually get archived.

That's money down the drain.

How the Safety Net Works

What we set up for them is a safety net. Any lead they can't reach by phone in the first 24 hours automatically flows through to our system. On day two, we send a WhatsApp message:

"Hi Sarah, we tried calling you yesterday about your mortgage enquiry but couldn't get through. Are you still looking for help with your mortgage? Here's a quick way to book in with one of our advisers."

The results are remarkable:

We're seeing a 71% open rate on these previously uncontactable leads and a 62% response rate. These are people who ignored multiple phone calls, but they'll read and respond to a WhatsApp message.

Not all of those responses are "Yes, book me in immediately." Some of them are just confirming their identity or saying "Yes, still interested but can you call me next Tuesday?"

But that's still incredibly valuable information because it allows the phone team to prioritise who to call the next day.

Instead of making 50 blind calls to people who may or may not be interested anymore, they can focus on the 30 people who actively responded to the WhatsApp and confirmed they want to proceed.

That's a completely different conversation. You're calling someone who's expecting your call, not cold-calling someone who's been ignoring you.

What Customers Actually Want

Here's the question everyone asks: don't customers prefer the personal touch? Won't automation feel impersonal?

The pushback we anticipated just hasn't materialised.

Let's be clear about what customers actually experience. They receive a WhatsApp message that says something like:

"Hi John, this is Lily from Heron Financial. I can see your mortgage with Santander ends on 15th April. Would you like us to help you find a better rate before it reverts to the SVR?"

That message is helpful, timely, and specific to their situation.

Most engaged customers simply respond:

"Yes please Lily, when can I speak to someone?"

They're not sitting there analysing whether Lily is human or AI. They're responding to a useful prompt about something that genuinely matters to their finances.

The Personal Touch Paradox

Here's what we've learned: customers don't actually want the "personal touch" during administrative coordination. What they want is:

Convenience

Speed

Respect for their time

The personal touch matters enormously when they're discussing their financial situation with an adviser, talking through product options, getting tailored advice. That's where human expertise and empathy are irreplaceable.

But booking an appointment? Being reminded about a renewal date? Answering basic qualification questions?

Those aren't moments where customers are craving a deep personal connection. They're moments where they want efficiency.

In fact, the traditional approach - leaving multiple voicemails, sending chase-up emails, playing phone tag for three days just to book a 30-minute appointment - that actually feels more impersonal to the customer.

You're treating them like a task on your to-do list that you keep failing to complete.

"Am I Speaking to a Bot?"

We do occasionally get customers who ask: "Am I speaking to a person or a bot?"

When that happens, our AI is completely transparent:

"I'm an AI assistant helping to coordinate appointments for the team. Would you prefer to speak directly with a human adviser instead?"

And you know what the most common response is?

"No, that's fine, just book me in."

Matt Coulson from Heron Financial told me they've even had clients call the office asking to speak to Lily, their AI assistant, because they've built a rapport through the WhatsApp conversations.

(Editor’s note: here’s exactly what Matt said about SalesRook, if you’re curious)

The staff have to explain: "Lily's our AI assistant, but I can help you with that."

The customers genuinely don't care. They just want their mortgage sorted efficiently.

The 11pm Advantage

There's also a timing element here that's crucial. A lot of these WhatsApp conversations are happening at 9pm, 10pm, even 11pm at night.

These are people who've just put their kids to bed, they're sitting on the sofa scrolling through their phone, and they're thinking about their finances.

They get a helpful reminder about their mortgage renewal, and they can engage with it right then and there.

If you tried calling them at 11pm? That would feel intrusive.

An email at that hour? Just sits in their inbox until tomorrow.

But a WhatsApp message? That's perfectly natural.

And the fact that it's AI handling it means they can have that conversation outside office hours without feeling guilty about taking up someone's evening.

The Spam Question

When you're sending hundreds of personalised WhatsApp messages simultaneously, at what point does it stop feeling like communication and start feeling like spam?

There absolutely is a line - and crossing it doesn't just annoy customers. It can damage the broker's brand and potentially get them in regulatory trouble.

The Line: Specificity and Relevance

The line, in my view, is specificity and relevance.

A spam message is generic, untargeted, and sends the same thing to everyone hoping something sticks.

"Are you looking for a mortgage? Call us today!"

That's spam, even if it goes to a hundred people or just ten.

What we're doing is fundamentally different.

Every message is built from data the broker already has about that specific customer in their CRM.

"Hi John, your mortgage with Santander ends on 15th April."

That's not spam. That's a genuinely useful reminder about something that directly affects that person's finances, sent from a company they have an existing relationship with.

Getting the Cadence Right

Scale does introduce risks if you're not thoughtful about it.

Here's where I've seen firms get close to crossing the line: frequency.

If you're messaging the same customer every week about their renewal, even with personalised information, that starts feeling like harassment.

Our typical approach is measured:

Initial message: ~6 months before product end date

First follow-up: 3-4 days later if no response

Second follow-up (occasionally): After a couple of weeks

Then stop for that campaign

If they still haven't engaged, the broker can then decide whether to move them to phone call efforts, or they might run a separate last-ditch campaign in the final six weeks before the rate expires.

That's helpful cadence, not pestering.

Multi-Channel, Not Multi-Message

What we're also building is the ability to coordinate WhatsApp communication alongside long-term email nurture sequences.

So instead of bombarding someone with WhatsApp messages, you might send them a brief WhatsApp:

"Hi John, with your mortgage ending soon, you might find this guide helpful," and link to a detailed article on the broker's blog or a downloadable PDF about remortgage options.

WhatsApp becomes the prompt. The email or content piece becomes the education.

It's multi-media, it's coordinated, and it respects that different types of communication work better in different channels. You wouldn't put 500 words in a WhatsApp message, but you can absolutely use WhatsApp to direct people to valuable resources that help them make informed decisions.

The Regulatory Reality

There's also a regulatory dimension here that's important. Under GDPR and PECR, the Privacy and Electronic Communications Regulations, you need a lawful basis to send marketing communications.

For existing customers, you generally have legitimate interest to send service-related messages about their mortgage renewal. But if you're sending promotional messages about additional products they haven't asked about, you need explicit consent.

We're very careful to distinguish between:

Service communications: "Your mortgage is ending, would you like help?" ✓

Marketing communications: "Have you considered our protection insurance products?" (requires consent)

Our Internal Rule of Thumb

If a customer received this message and thought "This is helpful and relevant to me right now," you're on the right side of the line.

If they thought "How did they get my number and why are they bothering me with this?" - you've crossed it.

There's also a practical consideration: WhatsApp has its own rules about business use, enforced through the WhatsApp Business API. If customers start blocking your number or reporting your messages as spam at high rates, WhatsApp will shut down your business account.

That's a pretty strong incentive to stay on the right side of the line.

Beyond the Budget

In the lead-up to the Autumn Budget, I've been seeing brokers get inbound enquiries from customers asking:

"Should I wait until after the Budget to remortgage?"

"Should I delay our house purchase until we know what's happening with stamp duty?"

The honest answer brokers have had to give is: "I don't know."

That's been creating a really uncomfortable dynamic because brokers are advice professionals. Their entire value proposition is providing clarity and guidance. But in recent weeks, they've been operating in an information vacuum just like everyone else.

The Pipeline Problem

The practical impact has been that conversion timelines have been stretching. Customers who would normally make a decision within two weeks have been saying "Let's see what happens after the 26th."

That means brokers' pipelines have been clogging up with enquiries that aren't converting to applications, which creates cash flow pressure because they're doing work but not completing cases.

At the same time (and this is the really painful bit), they couldn't slow down their activity because if they weren't generating and nurturing enquiries during the uncertainty, they'd have nothing in the pipeline when the Budget finally landed and people started making decisions again.

The Post-Budget Opportunity

As a new Budget lands, there's always going to be a surge of activity.

The brokerages that capitalise on that surge are the ones who can immediately engage hundreds of customers with personalised messages about how the Budget changes affect their specific situation.

"Hi John, following today's Budget announcement about stamp duty thresholds, you might now qualify for relief on your purchase. Would you like to discuss how this affects your application?"

That's exactly what we're doing with some of our clients right now - coordinated campaigns that go out within hours of the Budget announcement, reaching their entire customer base with relevant, personalised messages about how the changes affect them specifically.

And even if you've missed the boat for this particular Budget, this capability isn't just about one-off political events. There are market-moving announcements constantly:

Bank of England rate decisions

Lender policy changes

Regulatory updates

Brokers who work with us going forward will have this same ability to strike quickly whenever market conditions shift.

You can't do that at scale with manual phone calls. By the time you've called 50 people to explain the Budget implications, the market narrative has already moved on and another broker has captured those opportunities.

The uncertainty hasn't just been creating stress. It's revealed which brokers have the infrastructure to respond at scale when clarity arrives.

Whether stamp duty goes up, down, or stays the same, whether rates rise or fall, whether affordability rules tighten or loosen, none of that changes the fundamental reality that:

Brokers who can engage their entire customer base proactively and efficiently will capture more business than those who can't.

The Real Transformation

What we're really talking about here is recognising that some tasks can be automated at scale whilst preserving the human adviser's capacity for the work that genuinely requires their expertise.

The advisers at Heron Financial are coming into the office each morning with:

Appointments already booked

Fact-finds partially completed

Time to focus on actually giving mortgage advice rather than playing phone tag

That's the fundamental shift.

The Numbers That Matter

UK Finance data shows that around 1.6 million fixed-rate mortgage deals were due to end in 2025. With a similarly high number expected to mature in 2026, the volume isn't going to decrease.

The brokers who've built the infrastructure to handle this capacity challenge will capture the opportunity.

The ones still relying on manual phone calls and voicemail tag will watch clients revert to SVR whilst they're stuck leaving their fifth message for someone who may never call back.

The economics have already changed.

The question is whether your operation has changed with them.

Max Hardy is the Managing Director of SalesRook, a leading provider of AI-powered WhatsApp automation for mortgage brokers and estate agents.

About SalesRook

Transforming Mortgage Broker Communication Through AI

SalesRook transforms mortgage broker operations through AI-powered WhatsApp automation. Processing over 50,000 property and mortgage enquiries weekly, we help brokers capture more renewals, reduce costs, and deliver exceptional client experiences.

Recently featured in: Business Insider, Yahoo! Finance, Associated Press